Not just transforming businesses, but businesses transforming – that’s the power of Intelligent Document Processing (IDP).

Intelligent Document Processing (IDP) is a synergistic blend of Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning (ML). It radically reshapes how businesses handle the seemingly unruly unstructured data.

By 2030, Grand View Research anticipates the global IDP market to reach a staggering $11.29 billion, reflecting its incredible utility and a compound annual growth rate (CAGR) of 30.1%. IDP’s efficiency, accuracy, and speed in data extraction and analysis make it a game-changing phenomenon across various industries.

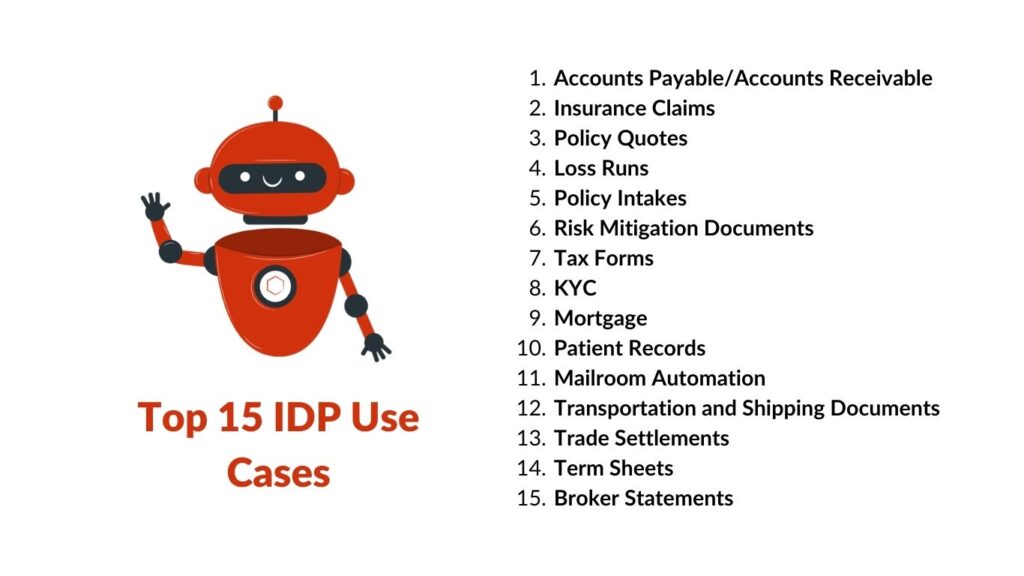

This blog post aims to outline the top 15 Intelligent Document Processing (IDP) use cases across various industries.

Top 15 Intelligent Document Processing (IDP) Use Cases

Here, we’ll explore the top 15 Intelligent Document Processing (IDP) use cases. This list will serve as a comprehensive guide to understanding how IDP can be used in different processes.

Accounts Payable/Accounts Receivable (AP/AR)

Intelligent Document Processing (IDP) utilizes Optical Character Recognition (OCR) to automate the handling of invoices, receipts, and purchase orders in both Accounts Payable and Accounts Receivable departments.

This technology simplifies the process of extracting important data from incoming invoices, thereby eliminating the need for time-consuming and error-prone manual data entry. By reducing potential errors, IDP enhances accuracy and efficiency in these critical financial processes.

Consequently, businesses can leverage IDP to optimize their payment processes, enhance accuracy in their financial transactions, and manage their cash flow more effectively. This ultimately leads to better financial management and improved business operations.

Insurance Claims

Intelligent Document Processing (IDP) leverages Optical Character Recognition (OCR) technology to automatically extract data from medical documents. This automation significantly reduces the time-consuming and error-prone process of manual data entry, thereby speeding up the insurance claims process.

This efficiency in handling insurance claims ensures an accurate capture of data, which is crucial to adhere to regulatory standards in the insurance industry. Consequently, the chances of non-compliance caused by human errors are drastically reduced.

In essence, the use of OCR and IDP in the insurance claims process is revolutionizing the industry, providing a more accurate, efficient, and customer-friendly service.

Policy Quotes

Intelligent Document Processing (IDP) greatly enhances the process of generating policy quotes. Traditional methods may involve a tedious, manual review of insurance applications and underwriting guidelines to gather necessary data. However, IDP automates this process by leveraging technologies like Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning (ML). It can swiftly scan and process diverse forms of documents, extracting relevant data with precision.

The extracted data is then analyzed to generate policy quotes. This not only ensures a faster turnaround time, but also increases the accuracy of quotes by reducing the risk of human error. Consequently, it allows insurance companies to provide timely and accurate quotes to their customers, improving customer satisfaction and operational efficiency.

Loss Runs

Loss runs play a pivotal role in assessing an insurer’s performance by providing comprehensive insights into their claims history, incurred losses, and overall risk exposure. Utilizing Intelligent Document Processing (IDP), crucial data points such as claim dates, types of losses, and claim amounts are automatically extracted from diverse sources like claims reports and summaries.

IDP is used to effectively analyze loss trends, evaluate risk profiles, and refine pricing strategies. It automatically extracts crucial data points such as claim dates, types of losses, and claim amounts from diverse sources like claims reports and summaries.

Policy Intakes

During policy intake, numerous documents need to be reviewed and relevant data extracted. With OCR, this process is automated, reducing the time spent on manual data entry and minimizing the risk of errors.

Furthermore, IDP ensures compliance with underwriting guidelines by accurately extracting necessary data. This can include a wide range of information, such as personal details of the policyholder, coverage details, and risk factors. By automating this process, IDP ensures a consistent, accurate, and efficient approach to policy intake.

Risk Mitigation Documents

Intelligent Document Processing (IDP) plays a crucial role in risk assessment and diligence checks within an organization. It automates the extraction and analysis of unstructured data, which can include a vast array of documents such as contracts, financial statements, identification documents, and more. This automation allows organizations to quickly assess risk profiles, spot irregularities, and take necessary actions.

In addition, IDP significantly aids in ensuring compliance with regulatory requirements. It can automatically check for compliance with various regulations, such as Anti-Money Laundering (AML) rules. By detecting non-compliance at an early stage, organizations can avoid penalties and protect their reputation.

Tax Forms

Intelligent Document Processing (IDP) transforms tax form handling, including W-2s and 1099s, alongside tax filings, by simplifying compliance with regulations. Through automatic data extraction via Optical Character Recognition (OCR), critical fields like taxpayer IDs, incomes, and deductions are swiftly captured, drastically minimizing errors and ensuring precise filings.

IDP solutions provide insights into tax responsibilities, deductions, and credits, enabling organizations to make informed financial decisions and strategically manage their taxes for favorable results.

KYC

Intelligent Document Processing (IDP), employing OCR technology, automates the extraction and analysis of data from identity documents such as passports and driver’s licenses. This automation expedites identification and verification by swiftly accessing crucial information like names, addresses, and dates of birth, enhancing operational efficiency.

IDP not only facilitates efficient identity verification but also aids in assessing risk profiles and conducting due diligence checks, ensuring compliance with regulatory requirements. This technology strengthens adherence to Anti-Money Laundering (AML) regulations, minimizes the risk of identity theft and fraud, and fosters smoother onboarding experiences, thereby bolstering customer relationships.

Mortgage

Intelligent Document Processing (IDP) can play a significant role in the mortgage industry. It can automate the process of extracting and analyzing data from mortgage applications and other relevant documents, such as proof of income, credit reports, and property appraisals. This automation not only accelerates the mortgage approval process but also reduces the likelihood of human errors that can occur during manual data entry.

Moreover, IDP can standardize the data extraction process, ensuring consistency and accuracy. It can also flag discrepancies or potential issues, allowing for quicker resolution and more efficient processing. By streamlining these processes, IDP can make the mortgage application process smoother for both lenders and applicants.

Patient Records

With IDP, healthcare providers can efficiently capture key information from patient records including medical history, treatment plans, and lab results. This not only streamlines administrative tasks but also enables healthcare professionals to focus more on patient care.

The automated analysis of data also supports better decision-making in patient treatment plans, as it provides instant access to comprehensive patient information. Furthermore, the high accuracy of IDP ensures reliable data extraction, which is crucial for maintaining accurate patient records and delivering high-quality healthcare services.

Mailroom Automation

Intelligent Document Processing (IDP) has the potential to completely transform traditional mailroom operations. Traditionally, mailrooms have relied on manual labor to sort through the high volume of incoming mail, which can be a time-consuming and error-prone process. It’s not uncommon for important documents to be misplaced or lost, which can lead to delays and other operational issues.

With IDP, however, incoming mail can be automatically scanned, categorized, and digitized. This automated process eliminates the need for manual sorting, which not only speeds up the distribution of mail within an organization but also reduces the likelihood of errors. As a result, the efficiency of internal operations is significantly enhanced, and the risk of losing important documents is drastically reduced.

Transportation and Shipping Documents

In the logistics sector, Intelligent Document Processing (IDP) acts as a powerful tool for automating and enhancing various operations. One key application is the automated processing of shipping documents, which can include vital paperwork such as bills of lading, packing lists, and delivery receipts. These documents contain crucial information such as shipment details, quantities, destination addresses, and other data necessary for smooth logistical operations.

IDP automatically extracts this data, significantly reducing the time and effort required for this critical task. This level of efficiency and accuracy can greatly improve the management of supply chains and logistics, leading to more streamlined operations.

Trade Settlements

Trade settlements refer to the transfer of securities from the seller to the buyer. Traditionally, this involves handling a large volume of trade documents, which can be both time-consuming and prone to human errors. By automating the extraction of data from these documents, IDP can greatly expedite the process.

This enhanced speed not only improves operational efficiency but also reduces the risk of costly mistakes. For instance, incorrect data entry could lead to erroneous transactions, potentially resulting in significant financial losses. Therefore, the use of IDP in trade settlements can improve accuracy, reduce risks, and contribute to the overall efficiency and profitability of financial institutions.

Term Sheets

Term sheets are crucial documents outlining the material terms and conditions of a business agreement between an investor and a company. These documents often contain key data points such as the investment amount, company valuation, and investor rights.

With IDP, these key data points can be automatically extracted with high accuracy, significantly reducing the time spent on manual data entry and analysis. This automation allows investors and decision-makers to easily evaluate and compare different investment opportunities on a consistent basis. Faster access to critical information facilitates quicker decision-making, which is essential in the dynamic world of investments where opportunities can emerge and disappear quickly.

Broker Statements

Broker Statements play an essential role in financial analysis by providing detailed information about transactions, fees, and account balances. Intelligent Document Processing (IDP) can significantly enhance this process by automating the extraction and analysis of this data. With IDP, critical details such as transaction history, incurred fees, and current account balances can be accurately obtained from broker statements, eliminating the need for time-consuming and error-prone manual data entry.

This automation not only increases the accuracy of the data used in financial analysis but also speeds up the process. Faster, more accurate data extraction allows for quicker decision-making, which is critical in the fast-paced financial sector. For brokers, this efficiency means they can provide their clients with timely and accurate information, aiding in the formulation of investment strategies and financial planning.

Conclusion

In conclusion, Intelligent Document Processing (IDP) is an innovative solution that is transforming business processes across various industries. Its ability to automate the extraction and analysis of unstructured data with high accuracy can significantly improve efficiency, accuracy, and speed in various business operations. From accounts payable to insurance claims, policy generation, tax forms, and even mailroom operations, the applications of IDP are vast and game changing. As businesses continue to embrace digital transformation, the adoption and implementation of IDP will undoubtedly become increasingly important. By harnessing the power of IDP, businesses can unlock unprecedented levels of efficiency and accuracy, paving the way for a more streamlined and effective operational future.

How RPATech Can Help?

We’re a company specializing in Intelligent Automation, utilizing AI to improve your business operations. See our Services & Solutions section for our full range of offerings.

Alternatively, you can book a consultation with our experts who will assist in identifying the best solutions for your business challenges.

We also offer a half-day discovery workshop. Here, we identify ideal processes for automation within your business, assess the feasibility and complexity of automation, and guide you on starting your automation journey.