Before we jump into the meat of the matter which is cost saving ideas for Chief Financial Officers (CFOs), let’s take a moment and imagine a scenario that will help us better understand the concept.

What would you do?

Let’s say you’re lost in a vast, thick forest, with no clear paths or signs to lead you out. You’ve got two choices: either battle your way through it with a machete, or use a GPS that guides you out without breaking a sweat.

Chose the GPS? High five! You’ve just made a decision that saves you a ton of time and potentially a lot of trouble.

So now let’s convert this scenario to our business world. What would you prefer – spending endless hours filling spreadsheets, fixing errors, and hiring more staff to duplicate data from one system to another? Or, would you choose a bot that copies data across the system in a few minutes, doing so accurately, and saving you valuable time and resources?

The decision between manual processes and automation is quite like choosing between the machete and the GPS.

Now, manual processes are like our old friend the machete. They’ve been around forever and might seem cost-effective and convenient at first glance. But on a closer look, they often lead to inefficiencies, much like hacking through the forest with a machete can be slow and prone to mistakes.

In this blog post, we’re going to help you spot the hidden costs of your manual processes and share some cost saving strategies for CFOs.

10 Hidden Costs of Your Manual Tasks

Cost savings are like the Holy Grail for CFOs. But the ongoing expenses of manual tasks can often slip under the radar, leading to costs that pile up.

Spotting and reducing the hidden costs that come from manual tasks is a key challenge CFOs face. Manual processes not only gobble up resources but also slow down efficiency and innovation, acting as roadblocks on the path of progress.

Let’s uncover 10 hidden costs that come from manual tasks, and see how they can affect your business.

Poor Productivity

If your employees are spending time copying data from one system to another, it’s time to rethink your strategy. You’ve hired a talented team for their unique skills, but if their time is being eaten up by mundane tasks, it’s not the best use of their potential.

Now, multiply this manual activity by the number of times they do this every day or every week, and you’ll see it results in a lot of wasted time, which could be better used elsewhere.

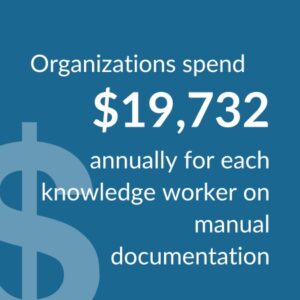

A study by IDC shows that employees spend 22% of their time on repetitive and manual tasks. They waste a ton of time every week dealing with manual documentation, costing organizations an average of $19,732 per knowledge worker per year in wasted time.

Slow Customer Responsiveness

Manual tasks can create a ripple effect on your customer services. The inefficiency of manual tasks affects how fast you respond to customers’ needs and questions, thereby impacting customer satisfaction levels.

In today’s world of instant delivery, customers expect quick services from companies. A survey suggests that 64% of customers want customer services to be faster. And the cost of customers switching due to poor customer service is a whopping $1.9 trillion.

Data Entry Errors

Clerical errors might seem small until they cost your company a lot of money. A famous example of such a cost is when Citibank accidentally wired $900 million to Revlon Inc’s lenders due to a clerical error. These lenders were already embroiled in a legal dispute with Revlon for many years, and Citibank lost the lawsuit to reclaim $500 million of the accidental payment.

This is just one instance of cost resulting from human error in manual tasks. But human errors are inevitable. People lose interest after spending hours on redundant tasks. Gartner reports that businesses lose an average of $15 million per year due to poor data quality stemming from errors.

Increased Labor Costs

Hiring people to simply copy and paste data might seem necessary, but considering the costs your company spends on training, payroll, facilities, equipment, and benefits, it might not be the best approach. You’ll need to hire more people for rework and data re-entry just to keep things going in the organization.

According to APQC’s database, organizations with manual processes reportedly spend $10 or more per invoice per FTE, whereas organizations with AP automation spend $2.07 per invoice or less per FTE.

Non-compliance Penalties

Non-compliance refers to failing to follow the rules and regulations that apply to your activity, industry, or organization, which could lead to legal action, fines, or even closure. Non-compliance can also damage your reputation and trust with your customers and partners.

Following the rules might seem expensive or time-consuming, but the truth is that non-compliance can cost you much more. A study shows that the cost of non-compliance is more than twice that of compliance. The cost of non-compliance includes not only fines and penalties but also lawsuits, settlements, remediation, and business disruption.

One of the most famous examples of non-compliance is the case of Wells Fargo, a major bank that was caught opening millions of fake accounts for its customers without their permission. This scandal led to massive outrage, loss of customers, and regulatory scrutiny. The bank had to pay $3 billion to settle criminal charges.

Cash Flow Inefficiencies

Manual cash flow management can lead to inaccuracies and inefficiencies, negatively impacting financial planning and liquidity. Manual processes often suffer from inefficiencies, including bottlenecks, delays, and redundant activities, leading to increased labor costs, missed opportunities, and decreased customer satisfaction.

Your business is also at risk of fraud if you manage your cash flow manually. According to GrowthForce, small businesses with fewer than 100 employees incur median losses of $200,000 due to fraud.

Audit Trail Gaps

An audit trail or audit log is a sequential record of every step performed to carry out a process. Its purpose is to have a record of all activities to identify or trace the source of errors.

Gaps in the audit trail can make it hard to trace the source of errors and reduce the accountability and transparency of business processes and transactions.

Gaps in the audit trail can also expose businesses to compliance and legal risks, such as fines, penalties, sanctions, or lawsuits. The Ministry of Corporate Affairs (MCA) in India has mandated businesses to comply with audit trails. Businesses could face legal actions from authorities and auditors if found non-compliant.

Gartner reports that businesses incur an average of $12.9 million costs every year due to poor data quality, which can stem from gaps in the audit trail.

Slow Decision Making

Have you ever come across the term ‘domino effect’? The term ‘domino effect’ refers to a series of related events, where each event triggers the next. This principle applies to various life aspects, including the business and corporate world. Poor data quality in a business can start a chain reaction, impacting the decision-making ability of business leaders.

Poor data quality increases the complexity of data ecosystems, making informed decision-making challenging. The time spent navigating through confusing data can slow down decision-making.

In a fast-paced business world, slow decision-making can be expensive. It’s not just about wasted time and resources, but missed opportunities. Every moment spent deciphering poor-quality data is a lost opportunity. The real cost of slow decision-making, caused by poor data quality, is the missed chances in a fast-moving business environment.

Expense Management

Are you managing your expenses manually? Does your team rely on paper receipts, spreadsheets, and email to record and process expenses? If so, what happens when a receipt is lost or a data entry is missed? Or, if there are duplicate submissions? It must lead to delayed reimbursements or extra time fixing the data, leading to increased costs.

According to Concur, manual expense reports cost businesses $35.02 on average to process a single report. This cost includes the hourly employee labour cost and the number of hours spent creating a single report.

Fraud & Security Risks

Manual processes often lack strong security measures, making them targets for fraud. This weakness comes from the absence of high-level security protocols to safeguard sensitive data and transactions. Therefore, these processes attract fraudulent activities, causing significant financial losses for businesses.

According to the Association of Certified Fraud Examiners, businesses worldwide lose about 5% of their annual revenue to fraud. This equals over $3.6 billion lost globally each year. This high figure highlights the pressing need for businesses to rethink their use of manual processes and explore safer options.

Manual processes also risk exposing sensitive data, such as employee or customer information. A data breach can lead to a loss of customer trust and harm the company’s reputation. In the worst case, businesses could face legal issues for not protecting sensitive information properly. Manual processes also open the door to internal fraud, where employees involved in financial transactions may misuse the data for personal benefit.

We’ve just explored a range of hidden costs that your business might be grappling with due to manual tasks. These costs, often overlooked, can significantly impact the financial health and efficiency of your business. Now that we’ve shed light on these hidden expenses, it’s time to focus on potential solutions. Let’s check 3 cost saving strategies that you can implement in your business to mitigate these costs, enhance efficiency, and optimize your operations.

Cost Saving Ideas for CFOs

Automation can create significant cost savings, improve efficiency, and increase the accuracy of financial operations. It’s not just about completing tasks quicker, but also about reducing human errors that occur with manual processes.

Your team can be freed from repetitive tasks and move into strategic roles that directly impact the growth and success of your business. Automation can change everything from data entry to report generation.

Below are three cost saving strategies for CFOs to optimize their operations:

Automate Your Manual Processes

Implementing automation in your financial operations can be a game-changer for your business. It is a strategic move that can significantly reduce the occurrence of errors, drastically improve the accuracy of your financial data, and save an immense amount of time that would otherwise be spent on manual tasks.

These automation bots, sophisticated and accurate, are capable of handling a multitude of tasks. They can manage your operations such as invoice processing, where they ensure that all invoices are handled efficiently and correctly.

They can also take care of expense tracking, a task that can otherwise be time-consuming, ensuring that all expenses are recorded and categorized correctly. Moreover, bots can effortlessly handle financial reporting, ensuring all data is accurate and up-to-date.

This frees up your team to redirect their focus towards more strategic and high-level tasks, enhancing productivity and fostering innovation.

In essence, implementing automation in financial operations is not just an expenditure, but a strategic investment that has the potential to dramatically transform your operational processes, making them more efficient and effective.

Leverage Data Analytics

Data analytics is a powerful tool that offers the ability to gain valuable insights into various aspects of your business, including spending patterns, operational inefficiencies, and potential areas for improvement.

It allows you to delve deep into the heart of the business operations and discover patterns or trends that might have been otherwise overlooked.

By leveraging these data-driven insights, Chief Financial Officers (CFOs) are able to make more informed and strategic decisions. These decisions are not just based on intuition or experience, but on solid, actionable data.

This can lead to significant cost savings as inefficiencies are identified and addressed, wasteful spending is reduced and resources are allocated more effectively. Data analytics is not just a tool, but a key driver that can turn your raw, unprocessed data into actionable insights, enabling the making of strategic and impactful business decisions.

Implement Cloud-Based Solutions

Cloud-based financial management solutions are an innovative and strategic approach to handling finances in the modern era. They offer the advantage of real-time access to financial data, which is crucial in making timely and informed decisions.

Furthermore, these solutions can significantly improve collaboration among your team members, enabling effective communication and efficient problem-solving. This is achieved by creating a shared platform where everyone can access and interpret financial data, thereby fostering a collaborative work environment.

Alongside these benefits, cloud-based financial management solutions also contribute to reducing infrastructure costs. By eliminating the need for physical servers and other hardware, these systems can save your business a considerable amount of money.

Therefore, transitioning to a cloud-based financial management system is not just a progressive step, but a holistic solution that comes with an array of benefits ideal for modern businesses.

Challenges Businesses Face When Automating Manual Tasks

Despite the undeniably significant benefits that automation brings to the table, businesses frequently encounter a multitude of challenges during the transitional phase towards more automated systems and processes. These potential obstacles or issues are diverse and may include:

Integration with Legacy Systems

In the contemporary business landscape, a significant number of organizations still operate using legacy systems. These are outdated information technology systems, software applications or processes that continue to be used, usually because the data or functions they support haven’t been upgraded or the systems are deeply integrated into other processes making change difficult. Unfortunately, these legacy systems may not be compatible with the latest automation tools that are emerging in the market.

This incompatibility poses a unique set of challenges, particularly when businesses begin considering the transition towards automated processes. Migrating from a legacy system to a new one is no small feat; it can be a complex, time-consuming, and costly affair.

However, while the road to automation may be strewn with these obstacles, it’s important for you to understand that the benefits of making the switch far outweigh the initial difficulties. Overcoming these hurdles can lead to a significant transformation in how your business operates, paving the way for increased efficiency and productivity.

Moreover, the transition from legacy systems to automated processes is not just about the immediate benefits. It’s also a forward-looking strategy that prepares your business for the future. As technology continues to evolve at an unprecedented rate, businesses that are still stuck with legacy systems will find it increasingly difficult to keep up.

On the other hand, businesses that have already made the switch to automated processes will be well-positioned to adapt to further technological advancements. They will be able to seamlessly incorporate new tools and technologies into their operations as they become available, thereby staying ahead of the curve.

Resistance to Change

Implementing change within any organization can be a challenging, multi-faceted process. The prospect of shifting towards automated systems can often be met with a degree of resistance or scepticism from employees. This resistance can emanate from various concerns, with the fear of potential job loss and a lack of understanding about the intricacies of how this new systems function being among the most common.

In some instances, your employees may worry that the introduction of automated systems could render their roles obsolete, leading to job losses. In other cases, the resistance could stem from a lack of comprehension about how these new systems operate and how their day-to-day tasks may be affected. Your employees might feel overwhelmed or intimidated by the prospect of having to learn and adapt to new technologies, particularly if they are not tech-savvy.

From the perspective of businesses, understanding these concerns and effectively managing this delicate process of change is of paramount importance. The transition to automated systems should not be a hasty process, but a carefully planned strategy. It’s essential to ensure that all employees are well-informed about what the change entails, how it will impact their roles, and how they will be supported throughout the process.

Thus, managing the transition towards automation is not just about implementing new systems, but also about managing change, supporting employees, and fostering an environment in which both the business and its employees can thrive. Successfully navigating this process can lead to increased efficiency, cost savings, and a more engaged, motivated workforce.

High Initial Costs

While the long-term benefits of automation are widely recognized, it’s important to note that the upfront investment required for the implementation of these systems can be notably high. This is a critical aspect that businesses must take into account when considering the shift towards automation. It’s not just about the tangible costs of acquiring and installing the requisite hardware and software, but also the broader financial strategy required to manage this significant investment.

The business landscape today is marked by increasing competition and rapidly evolving technologies. In such an environment, automation can offer a competitive edge by streamlining processes, reducing errors, and ultimately, saving costs. However, the journey to automation is not without its hurdles, with the high initial costs being a significant one.

The financial impact of automation is two-fold. On one hand, there are the initial costs that come with the acquisition and implementation of automation systems. On the other hand, there are significant cost savings and efficiency improvements that these systems can deliver over time. Businesses need to balance these two aspects when considering the transition to automation.

Moreover, businesses should not view the cost of automation in isolation. It’s not just about the immediate financial outlay but also about the potential for significant cost savings in the future. Automation can lead to greater efficiency, less waste, and lower operating costs over time. So, while the initial costs might be high, the return on investment can be substantial.

Conclusion

In the dense forest of business operations, manual processes can often seem like the trusty machete – familiar and reliable. However, just as a GPS can guide you out of the forest more efficiently and safely, automation can streamline your business processes, saving time, reducing errors, and ultimately saving costs.

By identifying and addressing the hidden costs of manual tasks, CFOs can significantly improve their organization’s bottom line. And implementing cost-saving strategies such as automation, data analytics, and the use of cloud-based solutions can contribute to achieving this goal.

While the transition to automated systems can present challenges, businesses that successfully navigate these can reap substantial rewards. With careful planning, clear communication, and a willingness to embrace change, CFOs can lead their organizations on a successful journey from the forest of manual processes to the clear path of automation.